Typically one option equals 100 shares of stock.Īn option contract that can only be exercised on the expiration date. Securities that give the holder the right to buy or sell a specified number of shares of stock, at a specified price for a certain (limited) time period. In the event that the holder of the put option decides to exercise the option, the writer's risk is more limited than it would be on an uncovered or naked put option. This limits the option writer's risk because money or stock is already set aside. Covered calls generally limit the risk the writer takes because the stock does not have to be bought at the market price, if the holder of that option decides to exercise it.Ī put option position in which the option writer also is short the corresponding stock or has deposited, in a cash account, cash or cash equivalents equal to the exercise price of the option.

#Trading options series

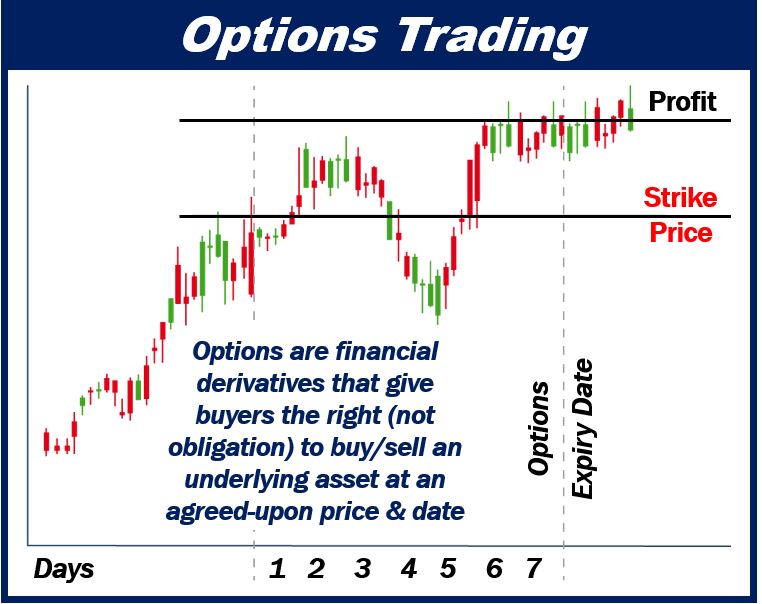

For example, if xyz stock is trading at 54, then the xyz 54 option is at-the-money.Īn option contract that gives the holder of the option the right (but not the obligation) to purchase, and obligates the writer to sell, a specified number of shares of the underlying stock at the given strike price, on or before the expiration date of the contract.Ī transaction in which the purchaser's intention is to reduce or eliminate a short position in a stock, or in a given series of options.Ī transaction in which the seller's intention is to reduce or eliminate his long position in a stock, or a given series of options.Ī short call option position in which the writer owns the number of shares of the underlying stock represented by the option contracts. The receipt of an exercise notice by an options writer that requires him to sell (in the case of a call) or purchase (in the case of a put) the underlying security at the specified strike price.Īn option is at-the-money if the strike price of the option is equal to the market price of the underlying security. Most exchange-traded options are American style. If you write a put, you are accepting the obligation to buy stock from the put buyer at the strike price at any time at the buyer's discretion up to the expiration date (as determined by the expiration month of the option you sell).Īn option contract that can be exercised at any time between the date of purchase and the expiration date.

Puts: If you buy a Put, you are buying a contract that gives you the right to sell 100 shares (usually) of a specific stock to the put writer at any time up to the expiration date (as determined by the expiration month of the option you buy). If you write a call, you are accepting the obligation to sell the stock to the call buyer at the strike price at any time up to the expiration date (as determined by the expiration month of the option you sell). There are two types of option contracts: a "Call" and a "Put."Ĭalls: If you buy a Call, you are buying a contract that gives you the right to buy 100 shares (usually) of a specific stock (the "underlying" security) from the option writer at a specific and fixed price (the "exercise" or "strike" price) at any time up to the expiration date (as determined by the expiration month of the option you buy).

0 kommentar(er)

0 kommentar(er)